Bullish superposition, copper price rise is not over yet

News on May 12: Since last week, international copper prices have been soaring, and the recent performance of Shanghai copper can also be described as a rainbow. On the one hand, with the steady advancement of global vaccination and the continuous recovery of the economies of various countries, the Fed’s biased attitude and the continuous decline of the U.S. dollar have given strong upward mobility to copper prices; on the other hand, the fundamentals remain bullish and short-term copper mine supply is tight. There is no significant improvement, which also provides strong support for copper prices.

The Fed's monetary policy continued to be loose in the first half of the year

After the widespread vaccination has effectively alleviated the epidemic situation, the economies of Europe, America, Japan and other economies have entered a period of strong recovery. The final value of the manufacturing PMI in the euro zone in April was 62.9, the expected 63.3, and the initial value of 63.3. The US manufacturing PMI has slowed down from a high level. The ISM manufacturing PMI index of the United States in April was 60.7, which was significantly lower than market expectations of 65.0, which was down from 64.7 in March, but it was still at a relatively high historical level. It is expected that with the implementation of large-scale fiscal stimulus and the expansion of the scale of vaccination, the pace of economic activity in the United States is expected to accelerate, and high growth will be achieved in the second quarter. At present, the Fed continues to maintain its accommodative stance, and Fed officials have repeatedly emphasized that even with the expansion of vaccination, the economic outlook is bright, but the US still needs active monetary policy support.

From the perspective of China’s economic performance, China’s official manufacturing PMI in April was 51.1, a decrease of 0.8 percentage points from the previous month, and the non-manufacturing PMI was 54.9, a decrease of 1.4 percentage points from the previous month, reflecting the Spring Festival in-situ Chinese New Year to a certain extent. The resulting peak season shifts, the sharp rise in raw material prices, and the impact of emission reductions and production reductions on production. It is expected that the Chinese economy will maintain a steady recovery in the second quarter, but the speed of economic recovery will slow down compared with the previous period.

The global supply of copper concentrates remains tight in the short term

Mining is the engine of Peru’s economy, and exports from this industry account for 60% of Peru’s total exports. Judging from the impact of the epidemic on Peru, the death toll in the second wave of the epidemic in Peru has far exceeded the peak of the first wave. In order to alleviate the second wave of the epidemic, the government implemented curfews, restrictions on the circulation of private cars on weekends and mandatory quarantine on Sundays. As a result of a series of measures, the current epidemic curve in Peru is showing a downward trend. From May 10 to 30, the epidemic risk level in Lima and Callao, the capital of Peru, will be reduced from “extremely high” to “extremely high”. "The epidemic prevention and control measures have also been adjusted, but it is still not ruled out that a third wave of epidemics will occur in the later period. The epidemic is still a sharp sword hanging in the sky. From the perspective of Peru's copper exports, Peru's copper exports in March increased by 6.69% from the same period last year to 173,700 tons.

As the world's largest copper mine producer, Chile's mine copper production accounts for a quarter of the world. The Chilean epidemic rebounded severely after March. Compared with the peak of the first wave of the epidemic in June last year, the rebound of the epidemic was even more severe. In order to strengthen the control of the epidemic, the Chilean government decided to close the border for 30 days starting from April 5. On April 26, the Chilean Ministry of Health confirmed that the Chilean border closure period will continue to be extended for 30 days until May 30. In addition, the issue of Chile's copper mining rights gold tax rate bill has caused concerns in the market. On May 6, the House of Commons of Chile's Congress approved a bill to raise the royalties of copper and other metal minerals, and the relevant draft legislation will be transferred to the Senate for voting. If the new bill is passed smoothly, it will increase the cost of foreign miners, reduce the economics of new projects, and reduce the supply of copper. But even if the bill is passed, it will not take effect until 2024. Therefore, the supply of copper concentrate will not be affected in the short term. Chile's copper production in March fell 1.2% year-on-year to 488,700 tons. Compared with the previous period, the pattern of copper mine supply shortage has shown signs of improvement, but the potential impact of the epidemic on the composition of mine output still cannot be ignored.

At present, the shipments of newly expanded copper mines are gradually increasing, and compared with the first quarter, the interference from the copper mine side has decreased, but there are still uncertain factors in the mine supply, which are mainly due to the copper mine strikes and community events. Impact on mine production.

The Chilean Los Pelambres copper mine union under Antofagasta accepted the labor contract with a 70.65% vote, which eased the risk of strike. Since April 26, Chile’s 25 port terminals and the Chuquicamata copper mine under Codelco joined the national strike, which ended on April 30 to urge Congress to approve the third withdrawal of pension funds, which is expected to affect 100,000 tons of copper concentrate. Shipment. However, Chilean Escondida copper mine workers are about to start negotiations on a new labor agreement in June. If the company and union negotiators fail to reach an agreement on the new agreement before the contract expires on August 1, the union may go on strike, posing a threat to copper supply. .

At present, the recovery of global copper mines is weaker than expected. According to the first quarter reports of major mines, copper production in the first quarter was reduced under the influence of the epidemic. Among them, the copper output of BHP, Rio Tinto, Nornickel and other mining companies in the first quarter decreased significantly. , But the 2021 annual copper production guidance target remains unchanged or increased.

Generally speaking, the current spot TC is still at a relatively low price, and the short-term global copper concentrate supply is still relatively tight. In the medium and long term, the investment in new expansion projects of global copper mines is gradually increasing, while the new capacity of rough smelting during the year is limited, and the tight supply pattern of the copper concentrate market will be improved. In 2021, the global copper concentrate will maintain a tight balance pattern. Taking into account the influence of interference factors, it is expected that the gap this year will be narrower than that in 2020.

China's copper concentrate dependence on foreign countries is as high as 80%

At present, the second round of the third batch of central ecological environmental protection inspection work is being carried out in China, and the supply of copper concentrate is relatively tight. China's copper concentrate output in March is expected to be 135,600 tons, an increase of 17.1% from the February ring and unchanged year-on-year. After the Spring Festival holiday, the mine gradually resumed production in March, leading to a situation of a month-on-month increase. From the perspective of copper concentrate imports, Chinese smelters are highly dependent on imported copper concentrates, and imports of copper concentrates from Peru and Chile account for more than 60%.

From January to March, China’s copper ore and copper concentrate imports totaled 5.962 million tons, an increase of 7.7% year-on-year. Among them, China imported 2.171 million tons of copper ore and copper concentrates in March, a record high, a year-on-year increase of 22% and a month-on-month increase of 20.94%. This was mainly due to the delayed ships in South America from January to February due to weather and logistics. Arrival. In March, China imported 825,300 tons of copper concentrate from Chile. It is expected that the delivery of 100,000 tons of copper concentrate will be delayed. From the perspective of the supply of raw materials for the smelter, the incident has no significant impact on the smelter. At the same time, affected by the high base number of arrivals to Hong Kong in March after the shipping schedule was delayed, China's imports of unwrought copper and copper materials in April were 484,890 tons, which was an expected month-on-month decline, with a month-on-month decline of 12.2%. This was an increase of 5.1% year-on-year.

The growth rate of domestic electrolytic copper production will slow down

Judging from the production situation of domestic smelting enterprises, smelter maintenance in 2021 will be concentrated in the second quarter. In the second quarter, there are 13 smelting plants scheduled for maintenance. Most smelting companies set the maintenance plan in early May, and the maintenance time is 25-40 days. It is estimated that China's electrolytic copper production in April will be 889,500 tons, a year-on-year increase of 15.1% and a month-on-month increase of 0.6%. After entering May, 10 smelters have overhaul plans, and the overhaul efforts are relatively strong. It is expected that the output affected will exceed the previous year's level and will reach 61,000 tons. It is estimated that domestic electrolytic copper production in May will be 844,900 tons, an increase of 18.5% year-on-year and a decrease of 5.1% month-on-month. It is estimated that in 2021, domestic electrolytic copper production will increase by 500,000 tons to 9.8 million tons, a growth rate of 5.4%.

In terms of refined copper imports, China's refined copper imports in March 2021 were 354,853 tons, a month-on-month increase of 28.8% and a year-on-year increase of 20.26%. From January to March 2021, China imported 912,900 tons of refined copper, a year-on-year increase of 1.98%. After hitting a historical high of 4.52 million tons last year, it is expected that imports of electrolytic copper will drop sharply this year.

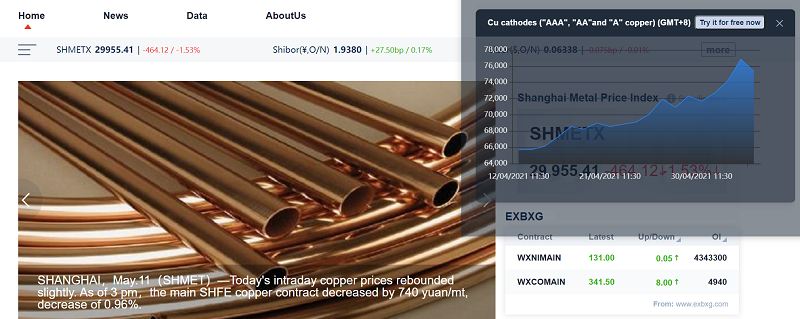

Global copper inventories are at historically low levels

In terms of explicit inventory, as of April 30, the total inventory of the world’s three largest exchanges increased to 404,000 tons compared with the same period in March. LME copper inventory, SHFE copper inventory and COMEX copper inventory were 143,700 tons, 199,000 tons and 6.65 tons, respectively. Million short tons. Although the global copper market's accumulation rate has increased recently, the global dominant inventory as a whole is still at a historically low level in the past five years. In terms of inventory in the bonded area, on May 6, the inventory in the bonded area was 418,000 tons, an increase of 5,000 tons from April 29. At present, the import window is still losing money, and the import loss is as high as 700 yuan/ton or more. Long-term import losses have resulted in few imported copper arriving in Hong Kong, and trading in the foreign trade market is thin.

Domestically, the planned investment in power grid projects in 2021 is 473 billion yuan, an increase of 2.8% over the planned investment in 2020. From January to March this year, the total investment in power grid projects across the country was 54 billion yuan, an increase of 48% year-on-year. With the boost from the start of infrastructure projects and other projects, the recent recovery of orders from southern cable companies has been obvious. The recovery progress of the northern market is relatively slow. In contrast, the copper delivery volume of State Grid in 2021 is relatively low, which makes cable consumption weak. As the downstream market's acceptance of high copper prices gradually opens up, cable consumption is expected to improve in the later period.

On the macro level, in the context of the worsening of the epidemic situation in some countries, the possibility of rapid tightening of global market liquidity is unlikely, and the monetary policy will not change direction in the first half of the year. Fundamentally, the recovery of global copper mines has fallen short of market expectations, and the tight supply of copper mines has not changed significantly. Although the accumulation rate of the global copper market has increased recently, the overall dominant inventory is still at a historically low level in the past five years, and the arrival of the peak period of maintenance of domestic smelting enterprises will suppress the production of later electrolytic copper. On the demand side, the high copper price has suppressed domestic downstream demand to a certain extent, and downstream orders are dominated by rigid demand purchases. It is expected that after the copper price adjustment is in place, it is expected to lead to a significant improvement in copper consumption in the second quarter. In general, it is expected that the main Shanghai copper contract will be dominated by high-level oscillations in the later stage, with the upper pressure at 80,000 yuan/ton and the lower support at 75,000 yuan/ton.